Everywhere you look doesn’t look like it looked before.

How do you make sense of chaos? How can you predict what’s next?

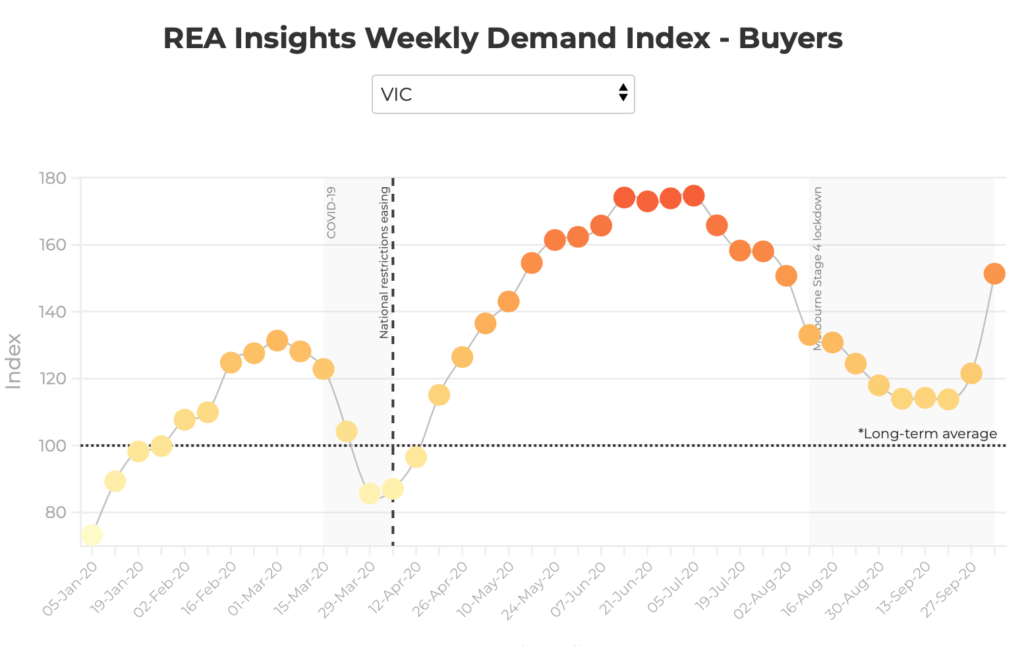

A glimpse at how we got here provides a clue. This is from realestate.com.au

Victoria’s first COVID lockdown near-killed buyer interest, it then rose well above the norm until taking another hit (but still above the norm) going into Lockdown 2.

It’s a nice predictor. If buyer interest is rising, you can assume activity comes next. But when the crowd at the top end is still confused, how do you work that out?

Start with Ron. Barassi.

“When nothing else works, go back to basics.”

Ron said that. Or something like it.

In real estate, it’s been a year on a skateboard

Taking Ron’s advice, look at the immutables. Start with gravity (your skateboard may emphasise that).

The force of gravity in real estate is money. At the top end we know there’s no lack of it.

Then …

Shock horror news for agents and sellers: You really don’t matter very much at all. It’s buyers who make markets.

Then …

When buyers say jump, markets jump (just not up).

But …

How does that work at the top? How can buyers get all their ticks in a row?

First by understanding that there is no top end market. Up here, every home is unique. Each is its own market, its own price point. Up here, each buyer is unique. Each is its own market. One buyer’s French Provincial dream is another’s nightmare.

If you’re buying, there’s little choice but to immerse yourself in the activity. This is a tribe. You have to hear its drums.

Nothing going?

There are agents who will tell you there’s little to choose, that vendors are holding back and that there are more who are ready to buy than ready to sell.

Yes. Not a lot of activity on the surface, but below it there’s some very athletic paddling going on.

Three $20m+ offers last week. One sold, one declined, one still thinking (and had the agent for the one that sold heard the drums, additional millions would have changed hands).

There have always been vendors who are big game fishing: hoping to land an innocent buyer who is embarrassed by cash.

There’s less of that around now. Those who are selling are there for real and ready to listen to realistic offers.

Peninsula feeding frenzy

$40m sale at Flinders.

Prices hiked 20% since Easter.

Record sales (we presume) of BMWs and Saville Row suits.

Too much love of tracky daks?

Agents who have decided that coming out of lockdown is all too hard and who will be left behind (and one who showed up all dakked out and was shown the door).

A sense that without the listings, without the big ad spends, the auctions and opens, many agents have lost the idea of what to do next, have lost their connections with buyers.

Meanwhile, in the rest of elsewhere…

Sydney’s gone nuts. Limited stock. White hot.

One Vaucluse auction shot 100% ($10.5m) over reserve.

NZ top end is saying goodbye to lockdown on the back of cheap money and strong demand.

MEL is being compared unfavourably to SIN — “Living in Singapore is now easier than living in Melbourne.” Will Asian money flee to Asia?

Seven weeks to Christmas Shutdown

Even in this spotty under-the radar market, time is still called. The annual cry of “If we don’t buy now, we won’t be able to move ‘til Easter.”

Don’t panic. There are choices. We’ve seen them.

You just have to hear those drums.

Stay well. Stay safe.